expanded child tax credit build back better

The House approval of the Build. February 3 2022 Topic.

Altogether Build Back Betters Child Tax Credit expansions full refundability and expanding the maximum credit to.

. The child tax credit was expanded for one year under the American Rescue Plan Act of 2021 ARPThe ARP increased the credit to 3600 per child under the age of 6 and 3000 per child between the ages of 6 and 17 note also that it increased the maximum age for. The tax credit was expanded earlier this year and increased the amount taxpayers can receive per child from 2000 to 3000 for children over the age of six and from 2000 to 3600 for children. Expanded Child Tax Credit has to be in final version of Build Back Better Act Sen.

Beyond child care support Build Back Better also includes the permanent expansion of the Child Tax Credit which expired in 2022. That increase begins to tail off sharply for couples making over 150000 and is gone. How Income Support Including Expanded Child Tax Credit Helps People Facing Economic Volatility.

Child 3000 per older child if taxpayer has a specified child for all 12 months of the year fully refundable adjusted for inflation young child. 2 days agoThe expanded credit was set to be extended in the Build Back Better Act President Joe Bidens massive public investment bill overhauling health care. 6-17 years old 1000 per child fully refundable not adjusted for inflation child.

The expanded credit which provides 300 per. The Build Back Better Act extends the expanded Child Tax Credit as well as the expanded Earned Income Tax Credit and the tax credit to help pay for child and dependent care. Monthly payments to families with kids known as the expanded Child Tax Credit could end December 28 if Congress doesnt pass Build Back Better.

The expansion reached 612 million children across more. The money in total supported 61 million children. Biden not sure enhanced child tax credit free community college will stay in Build Back Better.

Politics Joe Manchin Child Tax Credit Build Back Better Congress Is the Expanded Child Tax Credit Really Dead. Child Tax Credit Blog Brand. President Joe Bidens Build Back Better plan would extend expanded Child Tax Credit CTC monthly payments through 2022 and make these benefits permanently available to low-income families.

January 26 2022. Joe Manchin D-WVa killed President Joe Bidens Build Back Better plan journalist Luke ONeil collected testimony from a family who recently lost their child tax credit money as. By extending the expanded Child Tax Credit Congress can provide desperately needed support to families and pull millions of children out of poverty.

Senators Sherrod Brown D-OH Michael Bennet D-CO Cory Booker D-NJ Reverend Raphael Warnock D-GA and Ron Wyden D-OR sent a letterto President Joe Biden and Vice President. 0-5 years old older child. This provision is the main driver of the credit expansions child poverty reductions.

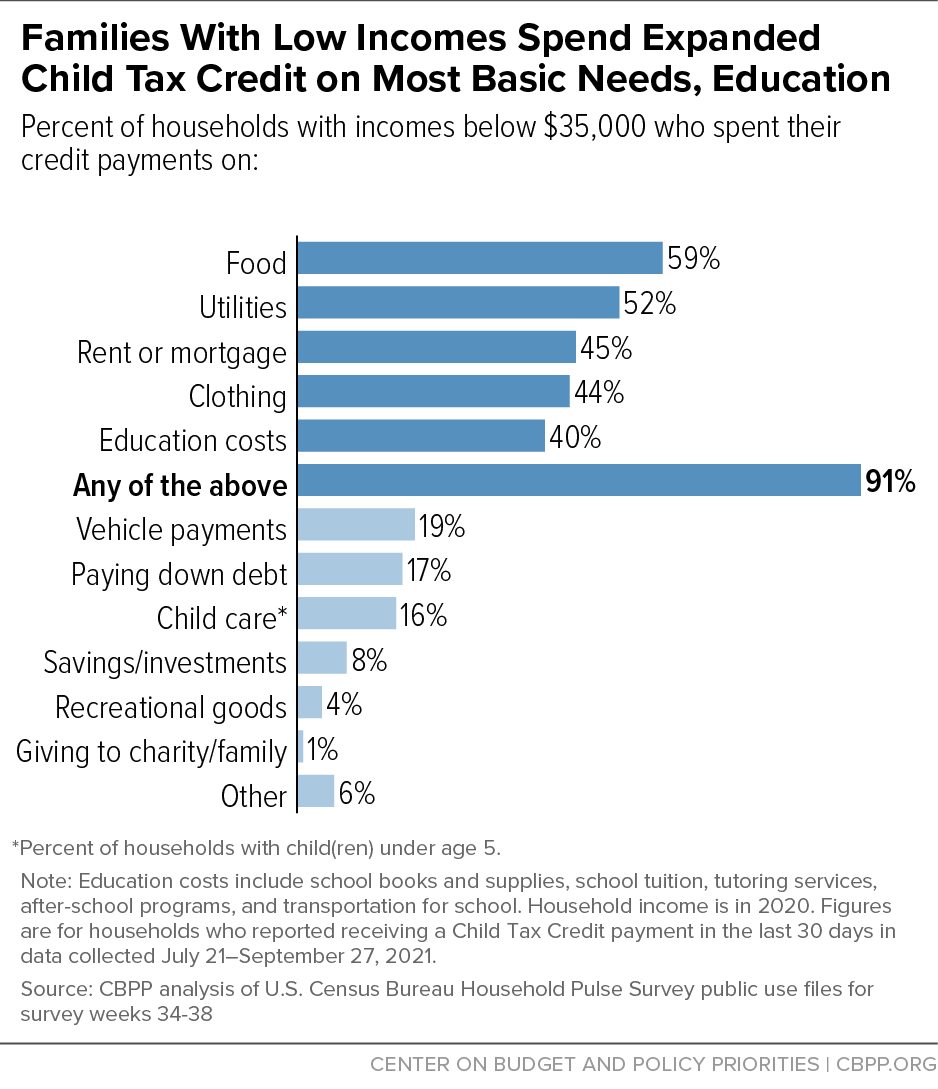

The EITC and expanded Child Tax Credit provide substantial income support but there are areas of concern that underscore the importance of other cash and near-cash programs such as SNAP and TANF working alongside tax credits. Since July of 2021 this provision sent low-income families monthly payments of 300 per child under six years old and 250 for a child under 17 years old. The Build Back Better Act increases the Child Tax Credit by 1000 to 1600 depending on the childs age.

The expanded child tax credit was in place for the last seven months of 2021 after it was passed as part of the American Rescue Plan Act. President Joe Biden holds a formal news. Last year 44 of adults reported they had skipped at least one medically necessary prescription drug due to cost.

0-16 years old Maximum monthly amountb 300 per young child 250 per older child. Brown Colleagues Urge Biden and Harris to Secure Expanded Child Tax Credit as Centerpiece of Build Back Better Package. While policymakers should ensure that the higher credit is made permanent even if the credit.

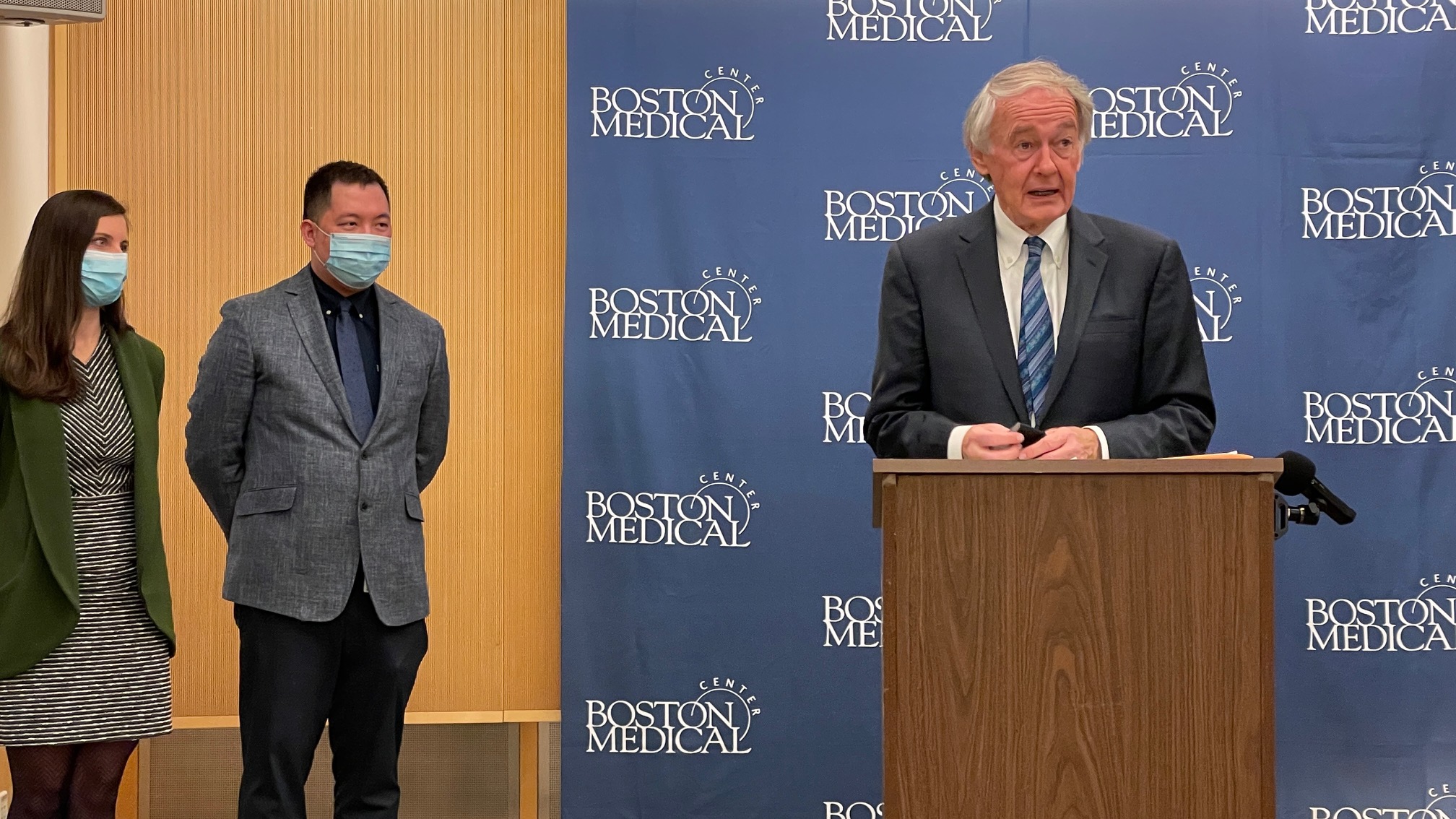

Ed Markey says. In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a. The Build Back Better framework will provide monthly payments to the parents of nearly 90 percent of American children for 2022 300 per month.

But now the expanded child tax credit has expired since Congress failed to pass the Build Back Better spending bill before the end of 2021. At the same time our country continues to face threats and increasing costs from climate changebut bold investments today will reap benefits for years to come.

Expanded Child Tax Credit Has To Be In Final Version Of Build Back Better Act Sen Ed Markey Says Masslive Com

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

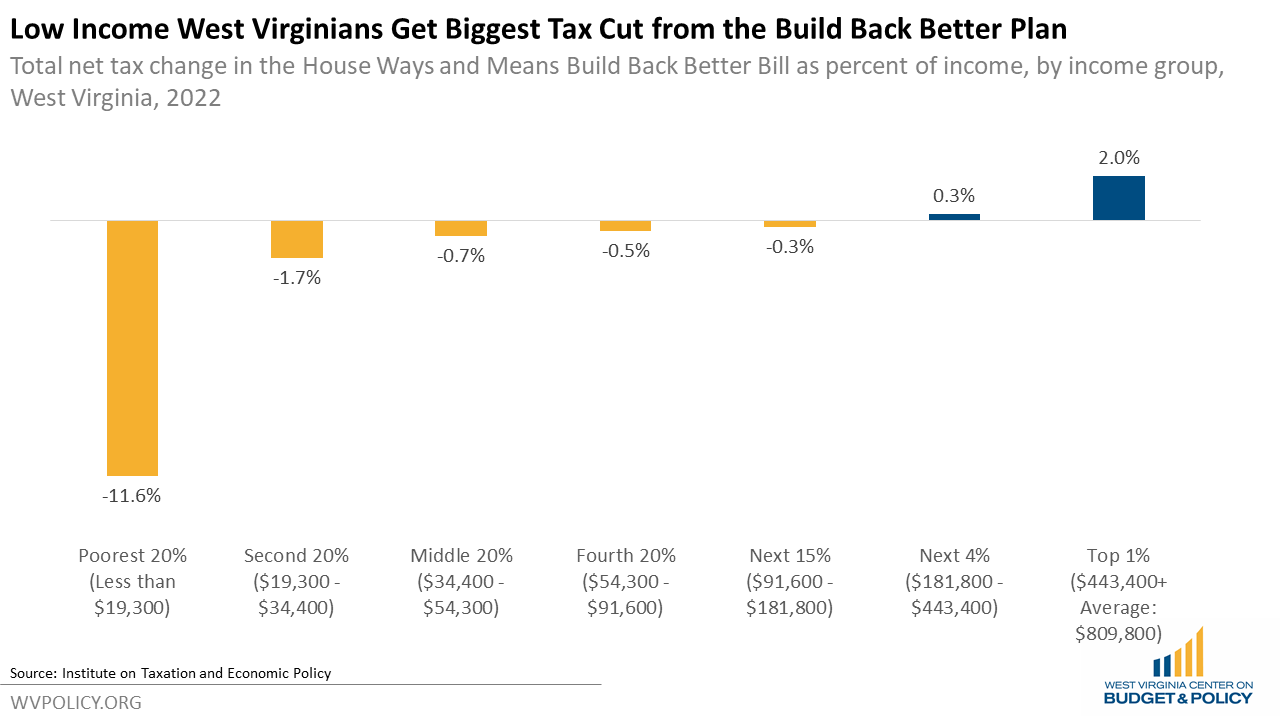

West Virginians And State Economy Will See Outsized Benefits From The Build Back Better Act West Virginia Center On Budget Policy

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

Five Facts On Build Back Better Act Provisions Realclearpolicy

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Biden Not Sure Child Tax Credit Free Community College Will Stay In Bill

The Build Back Better Framework The White House

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

Danilo Leandro Trisi Trisidanilo Twitter

The Build Back Better Framework The White House

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

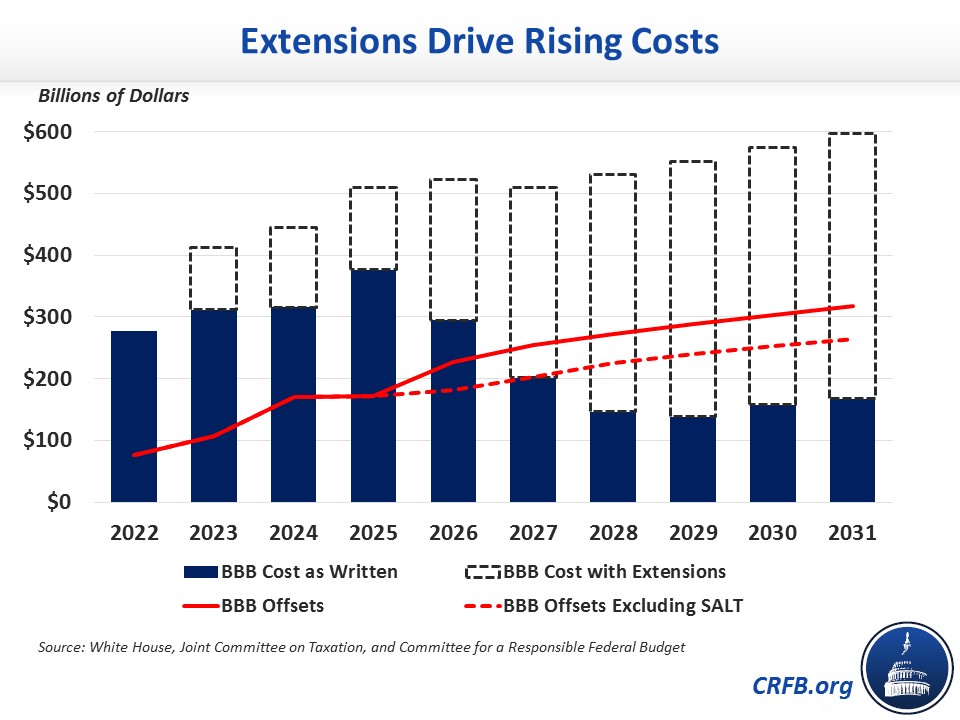

Build Back Better Cost Would Double With Extensions Committee For A Responsible Federal Budget

With A Smaller Build Back Better Here S What Aid Americans May Expect